The Truth on How to Build Great Seasonal Wine Lists

Many of the world’s best restaurants create menus that are inspired by seasons. Sourcing seasonal ingredients is fast becoming the standard way independent and even national chain restaurants operate. But how should restaurants deal with the seasons when it comes to wine?

Should restaurants adjust their wine lists to match the seasons?

Do wine drinkers’ preferences change on a 4-month cycle?

Let’s find out by digging into Uncorkd’s restaurant data.

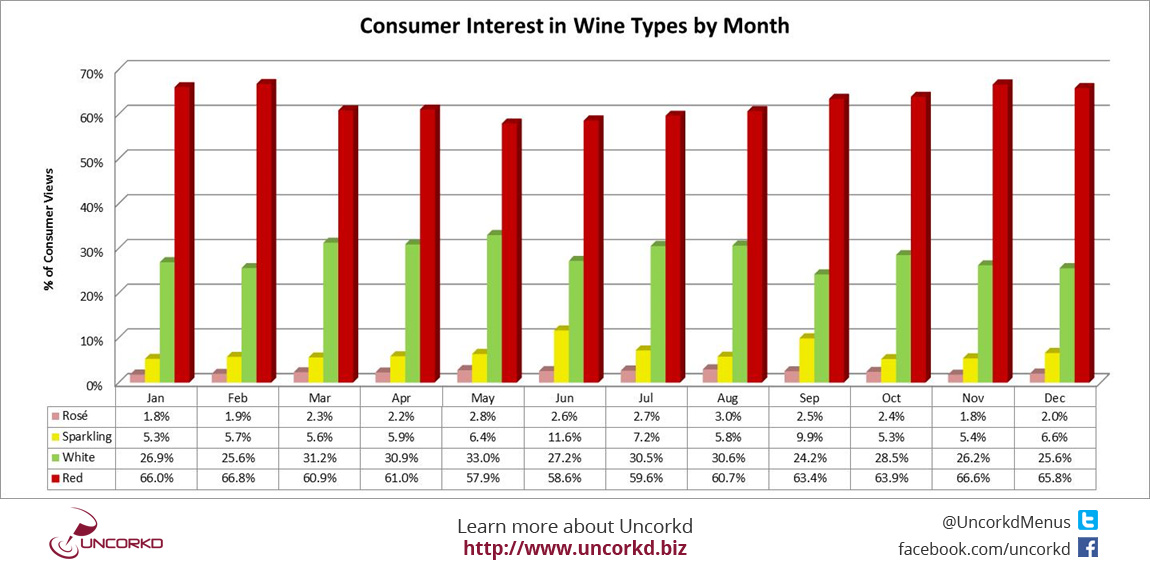

With Uncorkd iPad menus, restaurant operators can see what menu items their customers are interested in. When a diner views an item, that item view is tracked. It’s a great way for operators to understand customer interest in their menu, and how that interest changes throughout the year.

So how does customer interest in wine categories change with each season?

Sparkling Wine Has a Big Pop

Uncorkd was surprised to see that sparkling wine has the biggest percentage increase in customer interest between months. From it’s low point of 5.3% in January June peak of 11.6%. Increased interest in sparkling wine during the summer months isn’t all that surprising, but the size of the increase and the fact that it outpaced an overall increase for white wine is surprising.

- That’s a 119% increase in views between January and June!

Sparkling wine has peak interest running from May through September; September, the symbolic start of Fall, had sparkling wine at 9.9% of views.

Customer interest for sparkling wine across all Uncorkd menus for the past two years was at 5.6%. The number of sparkling wine options on menus totaled 5.91% of wine listings. So, restaurant operators are pretty close to matching menu listings with customer interest, but the monthly data shows opportunities for restaurants to capitalize on seasonally increased interest in sparkling wines.

For example, a restaurant would benefit from adding sparkling glass pours to their menu starting in June.

Where could restaurants improve their menus to match customer interest?

The rosé revolution has carried over into summer 2016. Wine writers are having a field day writing about the exploding popularity of rosé in influential markets like New York City and Chicago, and they’re making the most out of opportunities for puns like “brosé.”

But how is rosé represented on restaurant and bar menus throughout the U.S.? Are beverage directors and bar managers buying into the revolution?

It turns out, restaurants aren’t offering a lot of options for rosé.

According to Uncorkd’s menu analytics, rosé, sparkling and still, only represents 1.21% of all menu placements.

Despite the hype, restaurants aren’t loading their wine coolers with rosé.

What is the customer interest for rosé?

This is an important question for restaurant operators. Maybe, despite wine writers going giddy over the idea of brosé season, the demand doesn’t match the hype. Maybe restaurants know best when it comes to their customer preferences. Or maybe, restaurants are missing out an opportunity to increase their wine sales by not offering wine drinkers the chance to explore rosés.

According to Uncorkd data, the interest for rosé peaks at 3% in August. That interest is more than double the 1.2% of rosé wine listings at restaurants. This means that restaurants are loosing out on opportunities to sell more wine by restricting the number of rosé offerings on their menu.

Here are different wine styles and their peak month of interest for wine drinkers.

Contact Uncorkd to learn more about our on-premise menu data.

How can restaurants use this data to improve their wine lists?

- A wine program would benefit by adding more glass pours of sparkling wines during the summer months.

- Consumer interest in rosé is outpacing the number of rosés being offered on menus. Add rosé wines to your glass pour and bottle options.

- The average independent restaurant dedicates over 60% of their wine list to red wines. But red wine interest at these restaurants is 56.7%. Restaurants should replace their lowest performing red wines with in-demand styles.

- 5 Fall Cocktails to Capture the Flavors of Autumn - September 26, 2018

- How Restaurants Can Ignore Sales and Increase Profits - May 9, 2018

- 2018 Spring Wine Trends - April 18, 2018