Where Craft Beer is Losing on Restaurant Menus

How does the average restaurant divide its menu between craft and macro beers? When analyzing craft beer’s voracious growth, one of the most important measurements – both visually and economically – is how much shelf space craft brewers now occupy in grocery and retail stores. But what story is told by menu placements for micro (craft) beers ? In what venues is micro losing? Where does the golden-hued American lager still reign? We broke down Uncorkd customer menus to see how the average beer list is distributed between the firebrands and the titans of the industry.

A Quick Note on Our Numbers

Uncorkd is a digital menu service that helps restaurants build stronger beverage programs. Our software tracks menu analytics, which our customers use to improve their menus, beverage selection, and increase their beverage sales. We also use them to analyze beverage trends and provide big picture insights to our customers. We’ve broken down our customers’ beer placements and analyzed how these menus are divided between micro and macro beers.

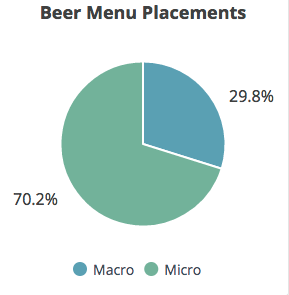

Here is the average menu split between micro and macro beers across all Uncorkd customer menus.

Average Beer Distribution on All Uncorkd Menus

You can see that on average, micro brews account for almost three-quarters of all beer placements on Uncorkd menus.

Menu distribution for micro vs. macro will tend to favor craft beers. Why? Because the craft market is crowded. There are now over 5,000 breweries in the United States. The number of U.S. breweries has grown almost 5x since 2008, when there were around 1,500 breweries. In 2014, craft breweries accounted for 98 percent of all breweries in the U.S. There are more craft brands in the market, and so, the opportunity for a craft beer to be listed on a menu is larger than that of a macro beer.

But let’s look at where craft beer is excelling, and where the areas for growth are.

Click Here to Jump to Our Interactive Beer Menu Placement Calculator

Where Craft Beer is Missing Out

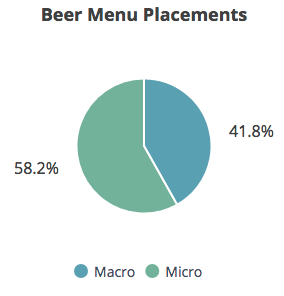

When compared to the average menu split, this is where craft beer is losing.

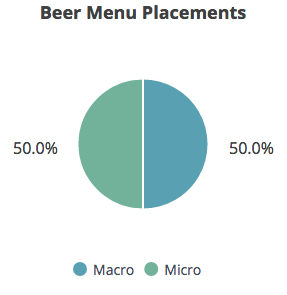

Restaurants with Check Averages >$61

At high-end restaurants, where the check average is above $61, there is a fifty-fifty split between macro and micro brews. This segment retains the highest percentage of macro beers for Uncorkd customers. Think steakhouse when looking at this category.

Where Micro Dominates

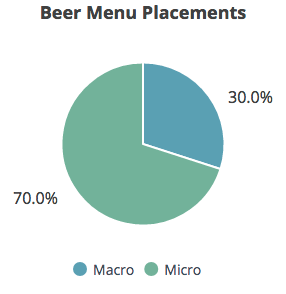

On the flip side, when you drop the check average down to the $10 – $30 range, the micro/macro split reflects the overall average of all venue types and check average. This includes a wider range of beverage-focused restaurants/bars and casual dining venues.

Restaurants with Check Averages Between $10 – $31

The distribution of beer placements in wine bars is even heavier in favor of micro brews.

Beer Distribution in Wine Bars

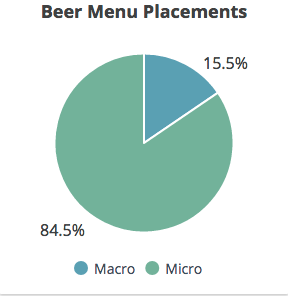

How Private Clubs Sell Craft Beer

Micro and macro beer have close to a sixty-forty split in the Private Club industry.

Private Club Beer Distribution

Have We Hit “Peak Beer”?

In last Friday’s Check Out, Uncorkd wrote about a war of words between Boston Beer Company founder Jim Koch and MillerCoors. The argument was centered on this question: Can craft brewers continue to grow their market share and remain competitive, or will brewery conglomerates stomp out competition through mergers and the acquisition of successful craft brewers?

Koch said “It could happen!” MillerCoors responded, “No it won’t!”

MillerCoors cited Nielsen data that found that craft owned 26.9 percent of grocery store retail shelf space, an almost 4 percent increase over 2015, as an indication that craft brewers shouldn’t worry. That number doesn’t tell the whole story, but it is telling of how competitive the craft category is in the retail trenches.

What This Means for Craft Brewers

In the on-premise segment, craft beers have higher visibility than they do in the retail space. But there are areas where craft beer hasn’t had as large an impact as it could. Across the country, in high-end restaurants and private clubs, where the demographic of customers is older, craft beer still has a lot of room for growth.

This is a positive finding if you’re worried that the craft beer bubble will burst. There are still areas where there is room for growth. It also means that high-end restaurants and clubs that must compete with growing quick-service restaurants may want to look at modernizing their beverage program as a way to attract new clientele.

Download Uncorkd’s Guide How to Increase Sales by Modernizing Your Bar.

Interactive Beer Menu Placement Calculator

Play around with our calculator by selecting different filters in the drop down lists to see how beer menus at different venues distribute beer selection. How does your restaurant compare?

- 5 Fall Cocktails to Capture the Flavors of Autumn - September 26, 2018

- How Restaurants Can Ignore Sales and Increase Profits - May 9, 2018

- 2018 Spring Wine Trends - April 18, 2018